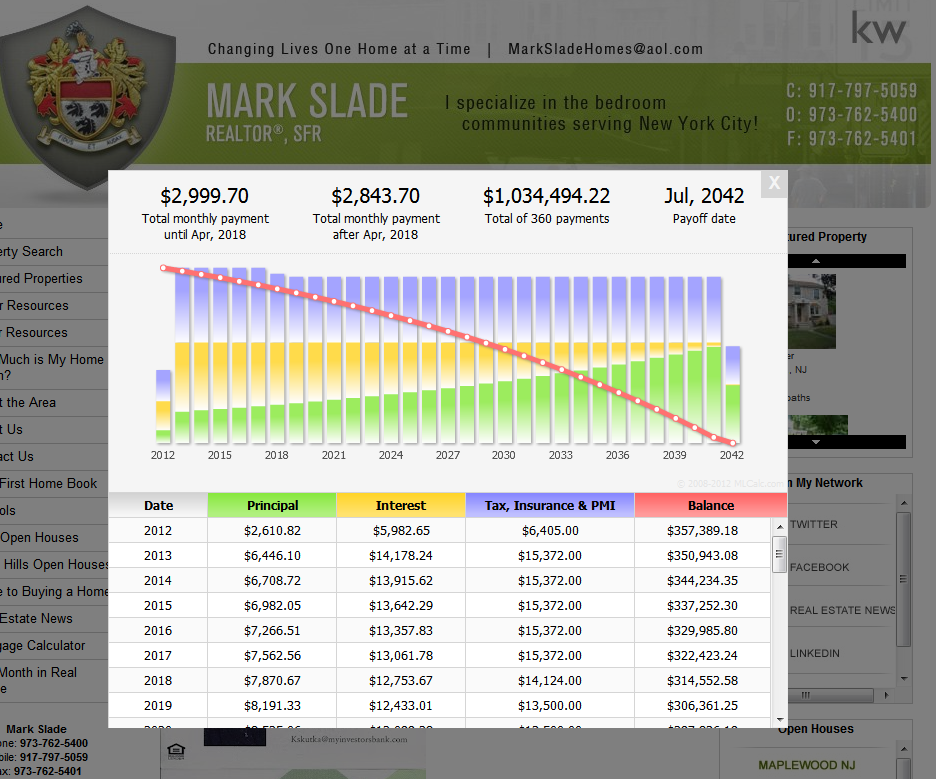

Receive a no-interest loan for up to $10,000, and pay it back over 30 years. The Housing Development Fund offers down payment assistance for residents of Washington, Connecticut. Veterans Affairs mortgage:These mortgages, also called VA loans, are for active-service military members or veterans, or spouses of members who have died and can provide lower interest rates than conventional mortgages.United States Department of Agriculture mortgage:These loans, also called USDA loans, can be useful if you are a low-to-moderate income borrower looking to buy a home in a rural or suburban area.Federal Housing Administration mortgage: You can get a down payment of 3.5% with a credit score of at least 580, or get a mortgage with a credit score between 500 and 580 with 10% down using this loan, which is also called an FHA loan.Mobile Manufactured Home Loan Program: If you are buying a mobile home or manufactured home, you can get a low interest rate and reduced closing costs.FHA 203(k) Renovation Mortgage Program: Get a low interest rate on a loan that wraps up the cost of home repairs into your mortgage.Down Payment Assistance Program Loan: You must borrow at least $3,000, but you can't borrow more than the minimum down payment for your home.The CHFA will cancel your mortgage insurance when you reach 20% equity in your home. Conventional Area Median Income Loan Program: If you have a low-to-moderate income, you can buy a home with no upfront mortgage insurance costs and discounted monthly insurance costs.(Some lenders in the US make you wait until you have 22%, but these loans let you off the hook at the 20% mark.) The HFA Preferred program is available for multi-family homes, but the HFA Advantage program is just for single-family homes. The HFA Advantage and HFA Preferred Loan Programs: Get a loan with reduced mortgage insurance costs, and you'll stop paying private mortgage insurance when you gain 20% equity in your home.The Connecticut Housing Finance Authority offers several financial assistance programs, including the following: Connecticut first-time homebuyer programs Paying an additional $500 each month would reduce the loan length by 146 monthsĬlick on "More details" to understand how various rates could affect your long-term finances.Lowering the interest rate by 1% would save you $51,562.03.Paying a 25% higher down payment would save you $8,916.08 on interest charges.

0 kommentar(er)

0 kommentar(er)